With a jug in place of magic pipe, John Stallwood hopped from corner to corner of the event in Guangzhou like a beer-touting pied piper. As sample after sample of Nail Brewing's Clout Stout was poured, more and more Chinese craft beer drinkers flocked to this strange, tall, dark-haired westerner.

The lure was more to do what was in his hands, however – the attendees couldn’t get enough of the iconic boozy black brew from Bassendean.

It was at that moment fellow traveller David Ward realised Australian craft beer could push into this great frontier. But he also realised it would take a lot of work to break into China.

“Seeing John that night changed my thinking,” says David, Australian Brewery’s sales manager, who, like Nail’s founder, was part of an Austrade craft beer mission to China in March.

“Our advice for China had always been that that is not the type of beer they wanted. But everyone was chasing John and his Clout Stout. He was there by himself and was struggling to pour the beers because of the people hanging around him.

“We learned that you need to look at the Chinese beer market in two categories. There is the crazy cheap beer, the Tsingtao, the Snow etcetera. And then there is craft beer.

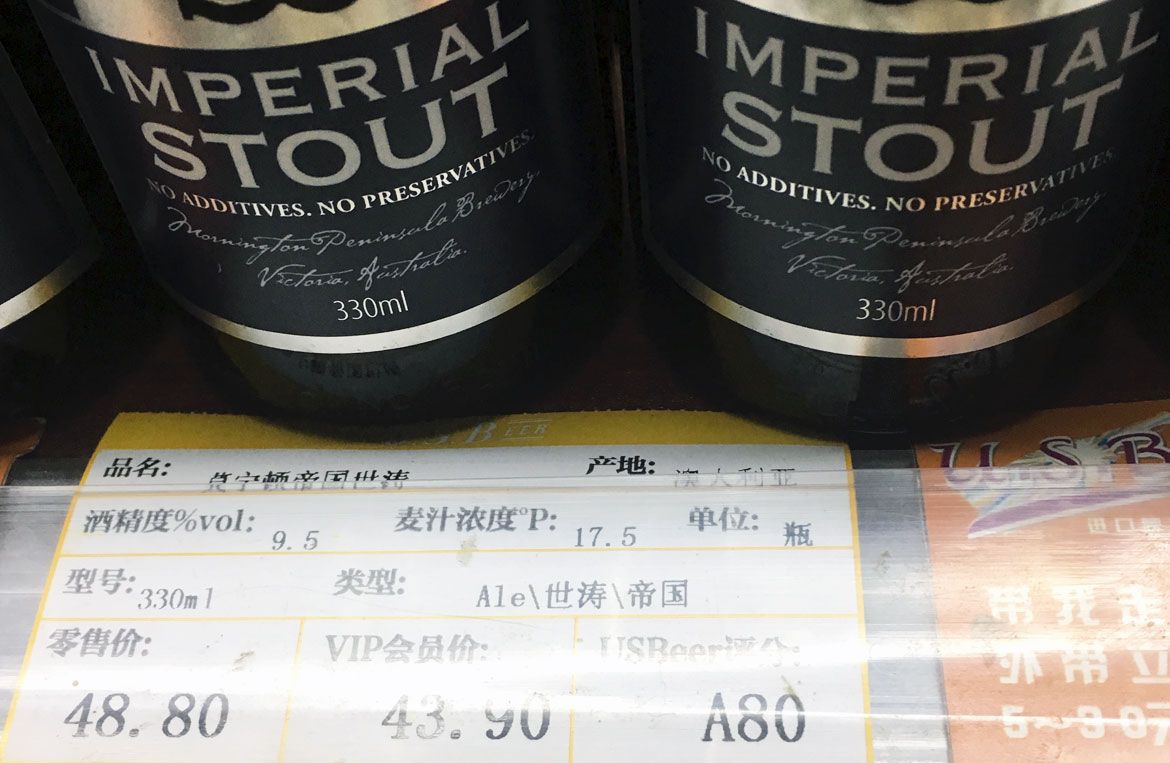

"We went out one night and we were drinking Goose Island for something like $14 (AUD) a pint. That is pretty steep in comparison to us in Sydney.

“So, we revised our prices up in China. Everything is bloody expensive when it comes to craft beer. But enough people pay and somebody is making the money. And at those [pricing models] there is room in the margins to be able to get our beers there.”

There are plenty of Australian brewers who would love to share in the spoils. After all, the imported beer segment among the 1.3 billion people within the globe’s most populated country is estimated to be worth $750 million a year according to the China Alcoholic Drinks Association in their report published in November. And it's growing. Fast. Very fast – certainly a lot faster than Australia’s craft beer market, deemed by business analyst IBISWorld to generate around $380 million per annum. The value of imported beer into China jumped 40 percent last year alone. It is that fast.

However, Australian beers are only securing around 0.2 percent of that trade. US counterparts are already operating in Shanghai, Beijing and Guangzhou with gusto while Lion has used its Little Creatures brand to make inroads into China and neighbouring Hong Kong. Indeed, Little Creatures has a pop-up bar in Shanghai; the overwhelming majority of craft beer in the country is consumed on premise and the bar allows Little Creatures to push the brand flesh in one spot.

Increasingly, China’s emerging middle class of 220 million people has a greater thirst for western products, including hoppy beers. Millennials in the country are keen to follow foreign trends and now have more disposable income to pay for them. At the same time, Australia is home to brewers producing some of the best New World brews on offer enjoys closer proximity than the other major contemporary craft brewing countries.

Yet, while almost all on the Austrade mission who got to see the industry close up are convinced China can be a land of opportunity for local beer makers, there was clear consensus it would take time and money to forge the links. And that's something beyond many local brewers battling to survive on the home front.

“Chinese craft beer is like Australia was ten years ago but it is catching up far quicker,” says Nail founder John. “Australia doesn’t have the craft beer name over there like the US, so it will take a lot of education and effort to get into that market.”

Temple Brewing’s Nick Pang has had plenty of business experience with the Chinese. Temple had a representative on the Austrade mission and has been selling Bicycle (its 4.2 percent ABV summer ale) and Anytime Pale Ale (4.7 percent ABV) in the region for almost a year. He believes it is time to strive for a piece of the pie in China but stresses the importance of having the right people on the ground.

“We started selling to China from July 2016,” says Nick. “Key reasons for this were that we believe we had the right people, given one of my business partners was based there, and there was an opportunity to sell beer to them utilising their existing relationships to retailers.

“We were also mindful that it was important to start targeting specific Asian countries for long-term growth opportunities

“The appeal is the size and mix of people in China. There is also a huge expatriate population there. Shanghai is a city filled with diverse groups of people and they have a very educated taste palate. I’m constantly surprised by their knowledge of craft beers when I talk to some of the craft beer venues there.

“The size of a city like Shanghai is huge and there are wholesalers, sub-wholesalers, distributors and sub-distributors. Working through the chain is challenging.”

There are also concerns the craft beer bubble in China is restricted to bigger metropolises. Snow and Tsingtao can still be bought for 80 cents a can in most of the country. Yet it must be remembered that, at 24 million, Shanghai has as many inhabitants as Australia. In greater China they consume 25 billion – yes, billion – litres of their favourite beers each year. If more are favouring imports then there are rich pickings for those with the right formula.

Start with the style of beer

The beers Chinese importers are seeking are not Budweiser clones, according to Ric Dexter, the Ballarat Beer Festival director who is also CEO of Freight Insight, a global logistics firm, and who recently entertained a delegation of Chinese buyers in Melbourne.

“I think I have figured out their craft beer flavour profile,” says Ric following the Chinese guests’ tours of Colonial, Two Birds, Temple, Hawkers and Fury & Son.

“They like strong flavours. They get plenty of Russian beers and Czech beers with wheat so they now look for something a little darker with more power and a solid but not too high IBU count. They are not frightened by high alcohol.”

That comes back to Clout Stout, a thick imperial stout that hits the ABV Richter scale at around 11 percent and is, accordingly, expensive to make and to buy.

Ric says a major deal was signed between the Chinese buyers and one of the breweries they visited on the tour, but couldn’t confirm which one due to business confidentiality. However, he said any local brewer thinking about a deal had to be able to produce a lot of beer. In a hurry.

“It was fascinating to see instant orders being made on this visit,” says Ric. “These delegations have no issue in making on the spot deals for 3,000 cases at a time.”

A pitfall Australian brewers seeking a place in China must be wary of concerns the value of their beers.

“Protecting your price is also important," says David, who has already helped establish 20 Australian Brewery taps in Japan and exports to India. "We heard from lots of importers that they could sell hundreds of containers a year but at ridiculously low prices.

“If you are producing 25 hectolitre batches like we are we couldn’t even get close to what they wanted and still have any margin for ourselves.”

That's where the US comes in. Their leading craft breweries dwarf Australian counterparts in terms of production capability. The Americans “have got the jump on us”, according to John.

What's more, Big Beer is not only dropping its own beverages into China but snapping up local craft beer talent.

“Boxing Cat, one of the biggest craft breweries who had a really cool bar we visited in Shanghai, got bought by AB InBev while we were there,” says David.

“AB InBev are going in and aggressively trying to acquire taps and breweries.

“Australia isn’t known in China for its beer. If the Chinese think Australian beer they think Foster's. The Americans basically own the craft beer market category. It will take education to fix that.”

However, unlike Australia, the lack of regulation surrounding beer in China and some help from the Federal Government have given our brewers access to new bars.

“There is less government regulation about what you can and can’t do in respect to blocking out taps and so on over there,” says David.

“We had lots of advice about protecting intellectual property and how important that is, language at different times caused some issues. Distance is a big challenge and that is why finding the right partners is so important.

“You must register brands in China before you go. [Brewers] should look at the EMDG program with Austrade before they go. Have a clear idea of what your brand is and how it looks to the Chinese consumer. Have a track record of your success in Australia as they do not want pop up marketing-only brands.”

Austrade offers Export Market Development Grants in which Australian companies can be reimbursed up to 50 percent of eligible export promotion expenses above $5,000 provided total expenses are at least $15,000.

“So, no matter what, it is going to be hard,” says David. “You have to invest in it. You can’t just pick a distributor and hope for the best. You need to invest time, money and marketing.

“But if you get it right there might be a good prize.”

We'll be running a second article on the growing craft beer scene in China in the coming weeks.

About the author: Ross Lewis is editor of beer website, The Sip.