When we were advised to keep an eye on the ASX on Friday morning, it set the mind racing. Hadn't it been Friday mornings when a number of the previous sales to multinational businesses had been announced? Did this mean Gage Roads, the publicly listed brewing company that had "returned to independence" less than two years previously was to be the latest acquisition? And would this mean anyone who'd celebrated the decision to award pouring rights at Perth's Optus Stadium to an independent would have to get used to Big Beer regaining its stranglehold on the country's major sporting citadels?

Or, given the upward trajectory being enjoyed by Gage Roads in the past few years – major trophies, signing significant partnerships outside the beer world among the highlights – was it more likely to be the declaration of another big deal?

In the end, it was in the latter category, with the acquisition of Broome-based Matso's for an initial $13.25m – and the launch of a drive to raise $10m via the issuing of new shares – one to be filed by the country's beer geeks under: "Ah, yeah. Makes sense." rather than a category marked: "Oh no, please don't tell me they've sold too..."

Gage Roads had been brewing beer for Matso's since 2007, with the two businesses effectively growing in tandem over that period; other than beers pouring at the Broome brewpub and a small amount of kegs, every single Matso's beer or cider you've consumed in recent years has been brewed and packaged by the company's new owners.

Aside from that, as part of Gage Roads' five-year plan announced in 2016, one aim has been to increase the amount of their own beers and ciders from what was around 25 percent, with the remaining three-quarters produced for Woolworths and Matso's. With this acquisition alone, that mix moves closer to 50:50.

"Our strategy has been about the conversion of contract brewed product into our own brands and this acquisition does that very quickly for us," says Gage Roads head brewer and COO Aaron Heary, who has played a central role in the brewery's rise in recent years and declared the Palmyra-based operation "really happy with the announcement."

He is quick to point out that the company wasn't actively looking to buy any other breweries or brands but was approached by the family that had launched Matso's with a 200 litre brewery setup back in 1997. But, once the team at Gage Roads looked at what it would involve, it made plenty of sense.

"The two companies have worked hand in hand since 2007," Aaron says. "We've grown up together and held hands as we've both grown into really important national brands.

"The Matso's brand is very strong with a loyal base of customers. There's people who buy their beers via Australia Post when they can't get it any other way and pay a fortune.

"The family wanted to see the brand continue to grow. They are really proud of what they've created with Matso's. The ginger beer is the biggest selling one in the country and has a really strong following, so for us it really made sense. It doesn't compete with anything we're currently selling."

If you're among Matso's loyal base, the good news is that nothing will change as the same people will be making the same beers and ciders with the same ingredients and recipes on the same kit. As when Mountain Goat sold to Asahi, the new parent company was already responsible for producing the vast majority of beer and had been for a number of years.

That said, you could argue the sale is more akin to that involving Vale Brewing and its associated brands last year. There, the family was eager to sell and found a buyer, Bickford's, that was an independent business from the same state, one best known for its soft drinks but also with an arm dedicated to alcohol, Vok Beverages. Indeed, Aaron says Matso's founders, the Peirson-Jones family, was keen to see their brand remain under independent WA ownership.

While the rate of openings continues to far outstrip the number of brewing companies closing or selling, at some point this growth will slow. One of the questions we have posed to the founders or new owners of the brewing companies that have sold in the past three years, for a follow up to this look at the issue of ownership, was whether they thought we might return to a situation where just a handful of brewing companies own every beer brand in the country.

On that, Aaron says: "In the broader market, I don't think we're at risk of going back to two companies that control the entire market anytime soon. Brewpubs and small, hyper-local brands will continue to flourish."

On the other hand, he describes the wholesale market as "very, very competitive", with anyone getting into that space needing ready access to capital to grow, strong sales and marketing and the capacity to cope if they're successful.

"That area will see brands come and go," he says. "The really, really successful ones might sell out but the current momentum is away from the duopoly.

"It's getting to the point of saturation with the number of breweries opening up. I sometimes feel for people getting into the market now, especially in the wholesale space. People go in with rose-coloured glasses and find out it's a lot more challenging, especially in some of the highly competitive states like Victoria, New South Wales and Queensland."

He also believes it's no longer good enough to make good beer as there's plenty of good beer now being brewed locally or imported from overseas.

"You've got to persuade someone to drink your brand and not someone else's and that's not a simple thing to do, especially if you don't have much resources. You need some X-factor that sets you aside from the rest of the pack.

"[These days] people know what craft beer is. They have their favourite beers and want to know what's different about yours."

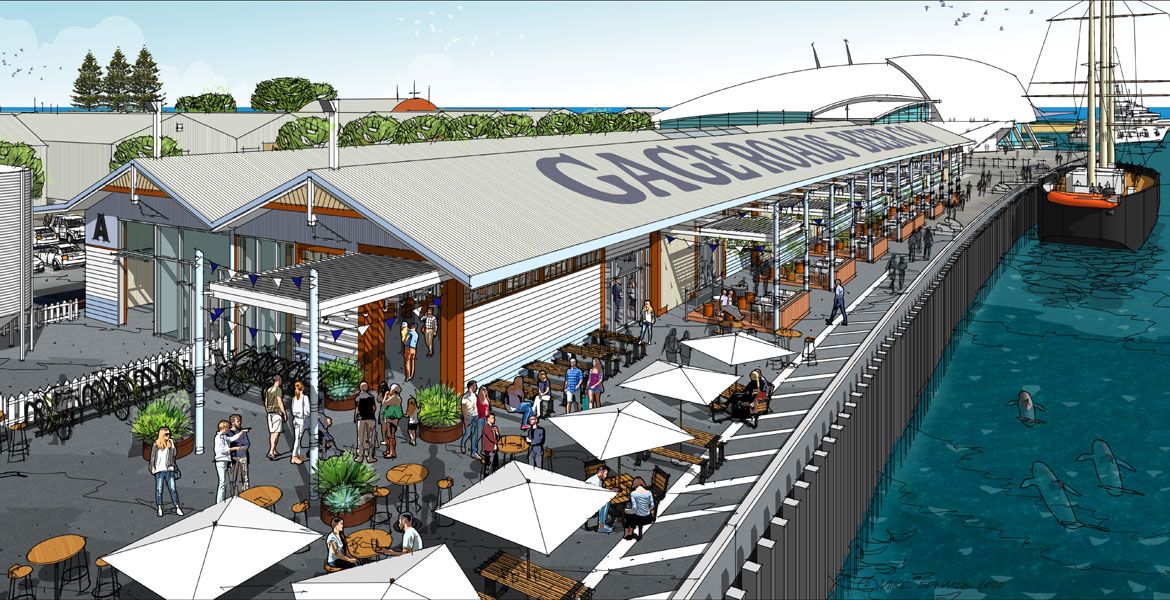

As for Matso's, whose beers have always been different to the pack, the brewpub will continue to be operated by the previous owners under licence from Gage Roads. And, says Aaron, there are no plans for any Gage Roads venues at this stage either.

"We've not been venue operators," he says. "It does come up from time to time and there's been a lot of people who've contacted us since we became independent to see if we'll start a venue with them, but it's not something we're pursuing and we don't have the capacity internally to do it.

"We're really focused on selling into the wholesale market. Once you start thinking about whether the fish is crispy or the chips are soggy you can take your eyes off the ball."