When talk turns to ownership within the beer world, the focus is almost exclusively on the brands that have been acquired by multinationals. Yet, as the local beer industry matures, we're seeing the rise of families of independent brands.

Whether bought or birthed in house, there are groups of distinct beverage companies – they typically go beyond just beer – that share common ownership. And it's likely we'll see more of these indie families over time too.

As things stand, you can look at the evolution of Gage Roads since the publicly-listed WA operation embarked on their "Returning To Craft" strategy – shedding Woolworths' partial ownership and looking to increase the ratio of beer and cider they produce for their own brands. Now you'll find Gage Roads beers sat alongside Alby lagers, Hello Sunshine Cider, the Atomic Beer Project and Matso's (the one brand they've acquired rather than created at time of writing) under the overarching Good Drinks sales and marketing banner unveiled in September 2018.

Then there's Fermentum, launched by the founders of Stone & Wood. Within the group you'll find the likes of Fixation Brewing, Granite Belt Cider, Forest For The Trees and the Square Keg distribution business. And there's Tribe Breweries, which evolved from BrewPack and now specialises in both "partner brewing" – producing a wide range of beverages for others – while also owning brewing companies Stockade Brew Co, which they built, and Mornington Peninsula Brewery and Wilde Gluten Free Beer, both of which they bought.

It's a situation that didn't exist even four years ago, so why are some of the country's biggest independents heading down that path now?

For Aaron Heary, head brewer and COO at Gage Roads, the benefits range from creating efficiencies in their sales force and diversification with their offering to simplifying matters for their trade customers.

"When we took the business independent and went to the open market in about 2016, we sort of foresaw that this would happen," he says. "We had a vision to become a national drinks company [and] when you empathise with the consumer in trade, they are seeing so many reps now, and we wanted to be able to be a solution provider."

The solution is to offer Gage Roads' lineup of craft beers as well as WA brewed lagers, a cider, hoppy beers under the new Atomic Beer Project banner, plus fruit and ginger beers from Matso's.

"Rather than the publican seeing five different reps," he says, "we can cover it in one call – we can talk about multiple taps or fridge space rather just one."

As well as looking at how the major brewing companies were operating, the Gage Roads team took stock of Stone & Wood's evolution via Fermentum, which the Byron Bay brewery's founders launched in 2015.

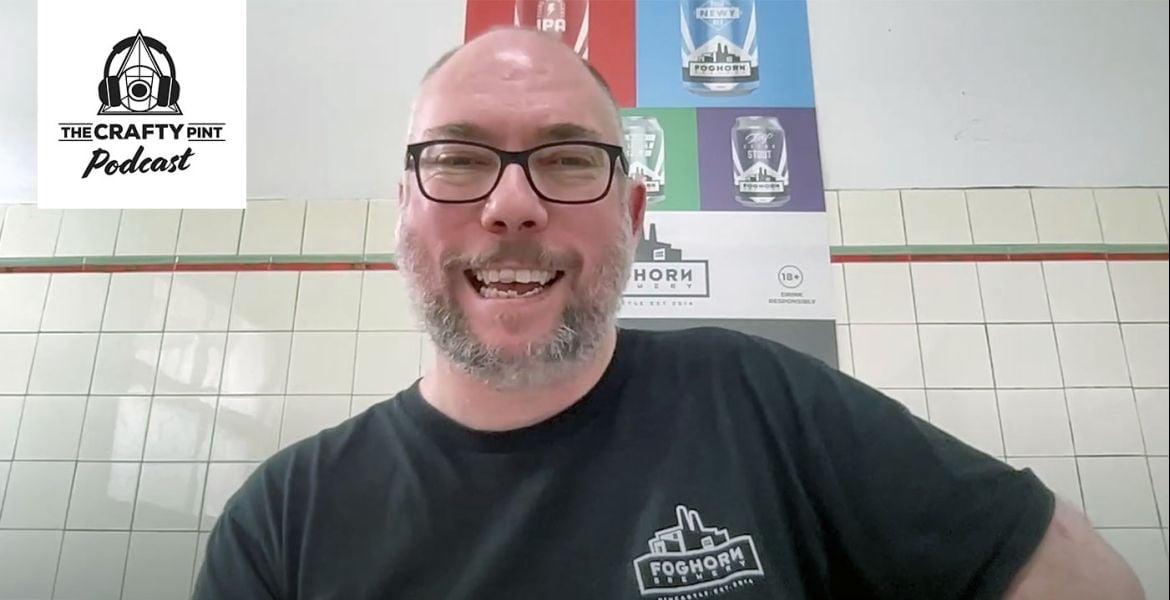

"We were seven years in and had stayed very focused on establishing Stone & Wood around a core range of beers and put everything into building capacity and capability in the team," explains co-founder Jamie Cook, who since we spoke for this article has announced he's stepping back from his role within Fermentum. "That meant over those years we had parked all the great ideas we had."

Along with co-founders Brad Rogers and Ross Jurisich, he says he'd always been a believer in the mantra that "the main thing is to keep the main thing the main thing" but by 2015 "there was a whole bunch of creativity that had to be released", not just from themselves but from team members who they felt needed to be given opportunities for personal growth.

"The three of us draw a lot of energy from building things and seeing people grow and evolve," Jamie says. "We get a kick out of ... seeing people who are really passionate about something grow and develop."

Furthermore, he says: "We are quite purist from a brand perspective. We liked the idea of doing different things and diversifying. There's a bit of a risk factor from having all your eggs in one basket, but it was more about ideas – looking for a way to provide opportunities for people."

At the time, they had been in conversation with other brewers who were looking to move on or exit their businesses but, according to Jamie, the valuations they were being quoted didn't make sense for them. Instead, they figured they were better investing in their own capacity and creating new businesses from scratch.

"It wasn't so much about business strategy, more about a family approach," he says. "It's great to see the likes of Tommy [Delmont] and Sam [Bethune] at Fixation and Garry [Hastings] at Square Keg, and even Brad at Forest For The Trees putting their passion into what they love.

"We are at a point now where we think we've got enough for a while. We also haven't turned our back on the idea of someone wanting to offload but it would have to be the right price and the right terms."

While such business structures might be new here, there are various examples in the US, often tied to private equity investment, such as CANarchy, the group backed by Fireman Capital Partners and featuring a lineup of brewing companies that includes Oskar Blues, Three Weavers and Cigar City.

As they set about building their $35m production facility in Goulburn, the family behind Tribe Breweries secured significant investment from Advent Partners, a Melbourne-based investment firm. But opening that facility – one of the largest in Australia – has been only part of Tribe's activity in recent years.

The company, which has evolved from the BrewPack contract brewing operation, has its own beer brand, Stockade Brew Co, complete with Barrel Room home in Marrickville, and has acquired Mornington and Wilde too. They're also involved in a Thai craft beer brand and are licensed to brew Pabst Blue Ribbon in Australia.

CEO Anton Szpitalak says their current trajectory wasn't part of the original plan when he was approached by one of his brothers about getting into the beer game, but has instead been a case of looking at where the beer industry is heading.

He says one of the advantages of their structure now, in which they own multiple breweries of different sizes, is that it "just gives us the flexibility to be more creative and nimble". In a fast-moving, consumer-driven market, he says they can now be "very dynamic and responsive".

Looking forward, he expects to see greater consolidation within the local beer industry, with more businesses banding together to drive economies of scale. Likewise, while he admits it's hard to make predictions on behalf of others, Aaron says: "I can only assume we will see more of it."

For those that have already started down that path, there's also the benefit of future-proofing their businesses. As the market evolves, having more strings to your bow makes you more likely to be prepared when the next big thing – be it cider, sours or kombucha – strikes. Or when the last big thing isn't quite so big anymore.

Says Jamie: "Pacific Ale has a certain kind of drinker. They're quite loyal but they drift off and try different things. Stone & Wood doesn't have things that are different enough.

"The other piece is, instead of everyone else trying to knock you over, you're better off knocking yourself over."

We've updated our infographic showing who owns which local beer brands to include the indie families – view it here. It's a fluid situation with AB InBev's sale of CUB and associated brands to Asahi still going through, but hopefully it's as accurate as can be.