"It's like death by a thousand cuts."

Nobody paying even the slightest bit of attention to the fortunes of the local beer industry needs to be told it's going through a rough period. Over the past 12 months, we've covered the fates of a number of businesses that have entered voluntary administration, shut up shop, or raised for sale signs.

We've examined the pressures that have led to such a situation, one in which a swathe of financial and economic headwinds have battered an industry already tired and reeling after years of bushfires, floods and lockdowns. And we've looked at ways in which businesses are looking to adapt to survive until the wider economic picture becomes rosier.

At the same time, as a beer drinker, you've probably noticed the price you're paying for beer – whether at your local or from a bottleshop – has been rising. And, in a climate in which "greedflation" has become part of everyday discourse, fossil fuel companies are reporting record profits, and just today Australia's two dominant retailers, Coles and Woolworths, have been shamed by Choice for "cashing in during the cost-of-living crisis", you could be forgiven for wondering if there's an element of crying wolf from the country's brewers.

But, as the slide into administration of serial trophy-winners Deep Creek across The Ditch this week indicates, and with more voluntary administrations likely on these shores, the reality is less "crying wolf" than crying out for a break. Because, while the price you're paying for beer might have gone up, the costs to brew that beer have risen far more.

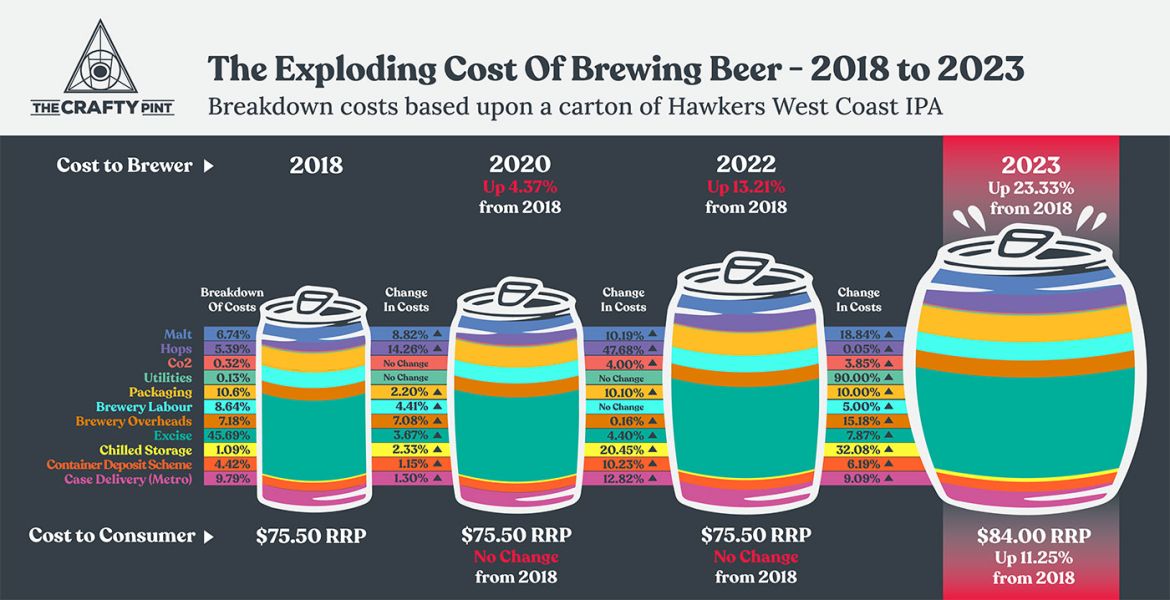

To highlight the harsh circumstances faced by Australia's brewers, Hawkers CEO Mazen Hajjar – whose quote is at the top of the article – opened his books for us. We broke down the individual manufacturing cost elements that go into every case of their award-winning West Coast IPA. And then we tracked how they had changed over the past five years, a period that covers the summer of bushfires in Victoria plus the peak years of the COVID pandemic, as well as the cost-of-living crisis.

The most simple, stark take home is this: from 2018 to 2023, the overall cost to the brewery of making that IPA rose by 23.33 percent – almost a quarter, while the recommended retail price for the beer rose by just 11.25 percent.

In other words, the cost of making a carton of West Coast IPA has gone up by twice as much as the cost to the consumer. What's more, the vast majority of that 23.33 percent rise has occurred since 2020, with the most steep increase between 2022 and 2023.

Examine the graphic more closely and certain other factors stand out.

Around 45 percent of the cost to the brewery of a Hawkers West Coast IPA is accounted for by excise tax. The cost of hops rose by almost 50 percent between 2020 and 2022, the cost of malt by nearly one-fifth from 2022 – the latter impacted by the war in Ukraine. The cost of utilities almost doubled in the past year, while other inputs – chilled storage and delivery costs, for example – have been rising fast too.

In an industry in which margins have always been tight, it's an unsustainable position, and one that has sharpened focus on key obstacles the industry has been trying, often unsuccessfully, to overcome since the craft beer revolution first took hold.

"The only thing inflation and rising costs are doing is accentuating or amplifying inherent problems that pre-existed in our industry," Mazen says. "We haven't addressed the two main issues.

"They are market access: not just tap contracts but concentration of retail power in the two national chains, who are now replacing craft with pseudo-craft on their shelves – and the concentration of venues in the hands of operators with hundreds of pubs who need to hit volume targets to receive rebates from the major brewing companies and so are blocking out independents.

"And the second is excise reform."

Earlier in the year, he described the tax system in Australia as "archaic", decrying the unequal treatment of the producers of different types of alcoholic beverages. As a result of the Wine Equalisation Tax (WET), wine is taxed on its wholesale value rather than its ABV like beer and spirits, so the cheaper the wine, the lower the tax price.

"Normally, people switch from wine to beer to save money," Mazen says. "But because wine is propped up by WET, beer becomes proportionally more expensive.

"Rather than fix the problem with excise, the government has given [the beer industry] this $350,000 rebate. 'Let's not upset the wine guys, we can easily buy the brewers off for $350,000.'

"But the rebate kills anyone in the middle. The big guys have scale and efficiencies so it doesn't matter to them; the small guys under about 150,000 litres a year are paying zero in excise; those in the middle are getting fucked from the top and the bottom – and beer's too expensive compared to wine."

Unbeknown to us, at the same time as we were compiling our graphic with Hawkers, the team at Wayward Brewing in Sydney was working on something similar. Last month, they released their Recession Ale, a beer designed to hit shelves at less than $50 a case while highlighting the cost pressures facing brewers.

The stats on their packaging break down the cost of beer by the time it reaches a consumer, as opposed to manufacturing costs, and include the margin applied by retailers. Above all, the messaging focuses heavily on the amount eaten up by tax – both excise and GST – in every beer you buy.

"Excise is out of control," is how Wayward founder Peter Philip puts it. "And it's very difficult to pass that on. Consumer confidence has been shaken and people have become very price conscious.

"We don't have the ability to pass on price increases because that would further slow sales, and further hurt small breweries."

It's also worth nothing here that, while the rate of excise tax paid by brewers has risen by 11.65 percent since the $350,000 rebate was introduced in July 2021, the rebate has remained static, thus decreasing its real value. To have the same impact for brewers today as it did in July 2021, it would also need to have risen by 11.65 percent to $390,775.

As such, the Independent Brewers Association (IBA) is calling for two changes in the short-term: a two-year moratorium on the indexing of alcohol excise, and to index the excise remission in line with excise rates.

It's not the only way in which excise tax is hampering the industry, either. During the COVID pandemic, the ATO allowed brewers to defer their excise payments, and many took advantage of the offer. Now, with the ATO seeking repayment at a time when businesses are struggling to survive, these legacy debts are hanging over many breweries like the Sword of Damocles.

Add in other issues – CO2 shortages that can put a temporary halt to production, for example, or the launch of Victoria's Container Deposit Scheme yesterday, which has led several brewing companies to notify their customers of price hikes in the past fortnight alone – and you can understand why Mazen says with a sigh: "It's one percent here, two percent there – it's just endless."

Looking ahead, with the Reserve Bank talking about further rate rises, Peter's not expecting things to take a turn for the better for at least another year either.

"How many will go out of business in the next 12 months?" he asks. "I know a lot that can't take anymore."

So, what might the future hold for the beer industry?

At a time when household budgets are stretched, are beer lovers going to be willing and able to pay more to keep their favourites in the fridge, or will they switch to cheaper offerings – even if only temporarily? After all, just this week, Endeavour Group (Dan Murphy's and BWS) reported a shift in spending towards cheaper mainstream products.

Short of praying for a bumper summer season, waiting for the global economy to change course, and hoping the damage to the industry in the meantime isn't too severe, what's the answer? Where's the ray of light piercing the gloom?

Mazen cites three key areas: freeing up access to the market for independent operators, tax reform, and consumer choice.

On the first of those, he says the current situation forces small breweries to "compete for one tap at the end of the bar with 800 other breweries because CUB have bought or paid for the other taps on the bar. That's not a fair marketplace. It's not doing anyone any favours."

Here, we should point out that some indie brewers also lock in taps at venues. Although, as one rep who admits to partaking in such practices put it to me, if that's what they need to do to compete within the current parameters, they will. But they'd stop if – ideally, when – the situation changes.

It's one area in which the IBA is hopeful of making progress by taking advantage of this year's Federal Parliamentary Inquiry into competition, as well as media attention on the industry, with IBA CEO Kylie Lethbridge telling The Crafty Pint she believes: "The ACCC is totally open to another investigation."

While the ACCC's last look at tap contracts in 2017 ended in a damp squib for the independent sector, Peter says the issue remains as vitally important as ever.

"We need real solutions to open up the market to all players," he says. "We're being locked out. I'd love the ACCC to have another look at it, because even Blind Freddie can see it's not fair."

On tax reform, Mazen says he just wants consistency: "The government needs to pull its head out of its ass. It's killing an industry.

"I'm not saying make beer cheaper or wine more expensive, just give everyone a fair chance. Just be consistent."

And when it comes to the specific issue of legacy debts to the ATO from COVID deferrals, the IBA is pushing on two fronts. They're providing advice for brewery owners currently in such discussions with the ATO, while advocating for the ATO to extend the period in which businesses can make repayments from the current 36 months to 72.

Kylie says this is "based on the proviso that if more [breweries] go into voluntary administration, the ATO loses out entirely."

She highlights other areas in which the IBA is pushing for positive change and greater support for the country's small brewers. She's hopeful there will be progress towards national harmonisation of the various container deposit schemes in place around Australia, which would help brewers save both time and money when it comes to registering new products.

When it comes to engaging consumers, they're launching mixed packs featuring trophy-winners from this year's Indies in partnership with Blackhearts & Sparrows, while the Coles Liquor Group has agreed to stock beers from IBA members and start displaying the independence seal in stores.

Yet, for all the impact such efforts behind the scenes can have, Mazen believes it is consumers who have the greatest power to decide how the future of beer in Australia looks.

"The only way forward is for consumers to understand that, while it may seem like a short-term fix right now to buy mainstream beer versus craft beer from local suppliers, ultimately every dollar we spend is a vote in the future we want," he says.

"We're at the cusp of the little guys being wiped out again. In good times, it's easy for consumers to spend a few extra dollars to buy local; in hard times, whether it's buying faux craft from the big chains or a brand owned by a multinational, it's easy not to think of the repercussions, but this is the time people need to double up and buy independent.

"It's really hard to make that call to people because they have their own battles to deal with to make ends meet, and we're asking them to dig deep. But otherwise, if it gets too hard and we lose too many operators, we will go back to the consolidation and commoditisation of beer."